The North American Kombucha Market in 2026: What's Actually Happening

The North American kombucha market hit $2.1 billion in 2025. Growth continues at around 14% annually—down from the 20%+ rates between 2018-2020, but still healthy in a wider beverage market that's moderating as post-pandemic consumption patterns stabilise.

That slower growth isn't a problem. It signals something more interesting: kombucha is transitioning from niche wellness product to mainstream beverage category. It's in every Walmart, Target, and conventional grocery chain across the US and Canada now. The brands figuring out how to win in that environment look very different from those that dominated the Whole Foods era.

This breakdown walks through what's actually happening in the North American kombucha market heading into 2026—the consumer shifts, regional dynamics, competitive threats, and distribution opportunities that matter if you're trying to build or grow a brand.

Download our free 2026 Global Kombucha Report for exclusive insights into shifting consumer habits, regional trends, and the production strategies that will help you capture the next wave of growth.

Market Size and Who's Winning

North America's kombucha market reached $2.1 billion in 2025. The United States dominates at roughly 85% of sales. Canada represents 15%, with particularly strong growth in Toronto, Vancouver, and Montreal. The biggest shift in the North American market isn't the numbers. It's how US and Canadian consumers think about kombucha.

Purchase Motivations Are Changing

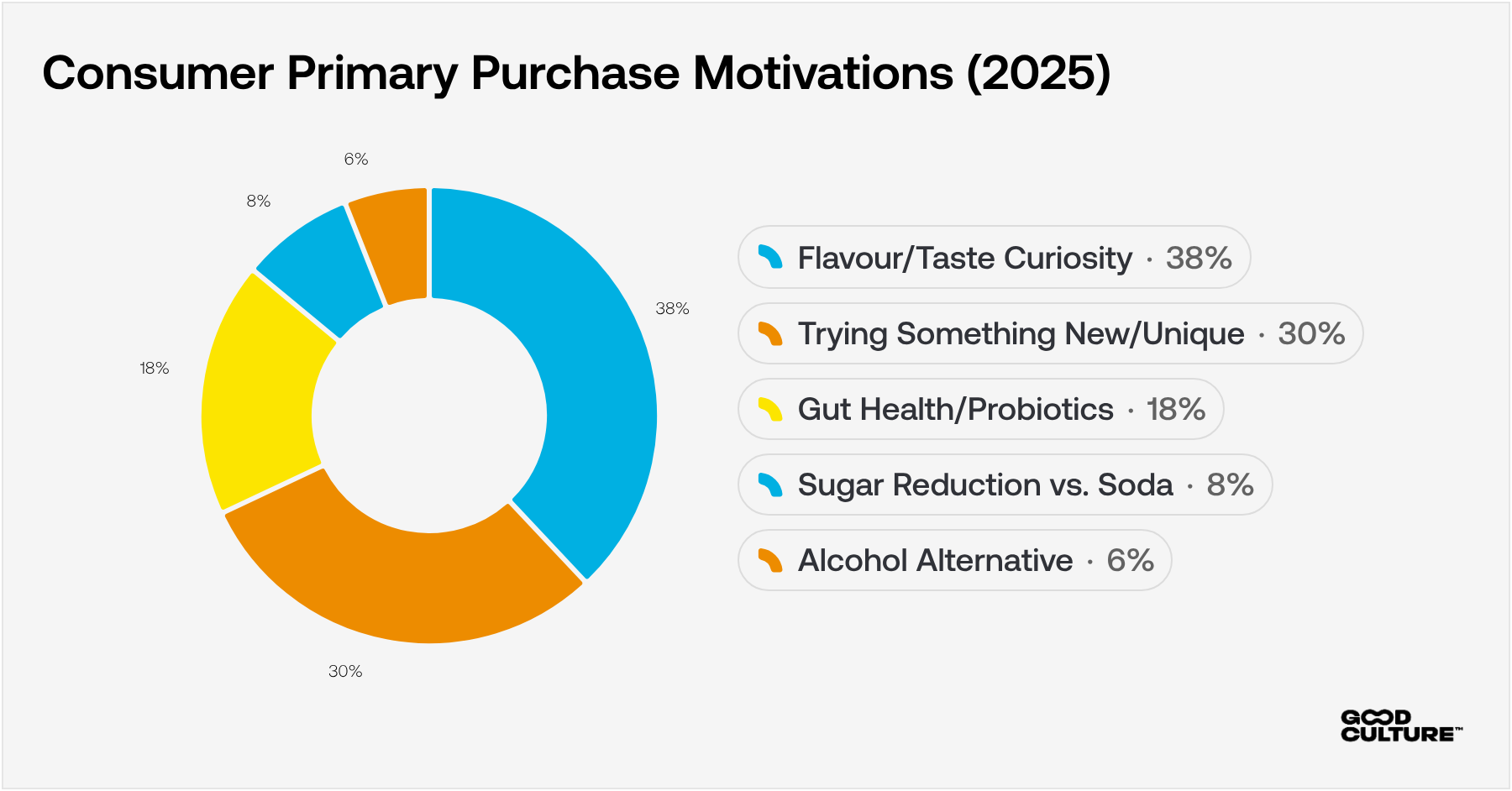

First-time North American buyers increasingly cite "flavour curiosity" or "trying something new" as their main purchase reason - not health benefits.

Gen Z and millennials (who drive 65%+ of US purchases) view kombucha as everyday refreshment that happens to have functional benefits—not a supplement they tolerate for gut health. That fundamentally changes what wins in retail.

Brands that figured this out early are thriving. Health-Ade leads with fruit-forward taste stories. Remedy hammers "No Sugar. Loads of Flavour." GT's spans 50+ flavours because variety drives repeat purchases when consumers are shopping taste, not function.

The health story still matters. But it's not doing the heavy lifting anymore. It's table stakes. The brands winning shelf space in Target and Walmart are the ones leading with "this tastes great" and mentioning "oh, and it's good for you" second.

New Drinking Occasions Across North America

Kombucha is showing up in moments that used to belong exclusively to coffee, soda, or alcohol.

Morning routines are one of the fastest-growing occasions in US markets. Office workers in major metros - New York, San Francisco, Chicago, Boston, Seattle - are swapping morning coffee for kombucha. The combination of natural caffeine from tea, B vitamins from fermentation, and perceived "clean energy" appeals to productivity-focused professionals.

Canadian consumers in Toronto and Vancouver show similar adoption patterns. Tim Hortons and Starbucks have kombucha now. That's not an accident. It signals where morning beverage occasions are heading.

Social settings in North American bars and restaurants present another opportunity. Hard kombucha's success (particularly strong in California, Oregon, Washington, Colorado, and British Columbia) has normalised kombucha consumption in settings where it would have felt awkward just a few years ago.

When consumers drink hard kombucha at a bar, they're more likely to buy non-alcoholic versions at the grocery store. The halo effect is real and something you can measure across North American markets.

Where the Growth Is Actually Happening

The North American kombucha market is broadening geographically in ways that create real opportunities for brands willing to target them.

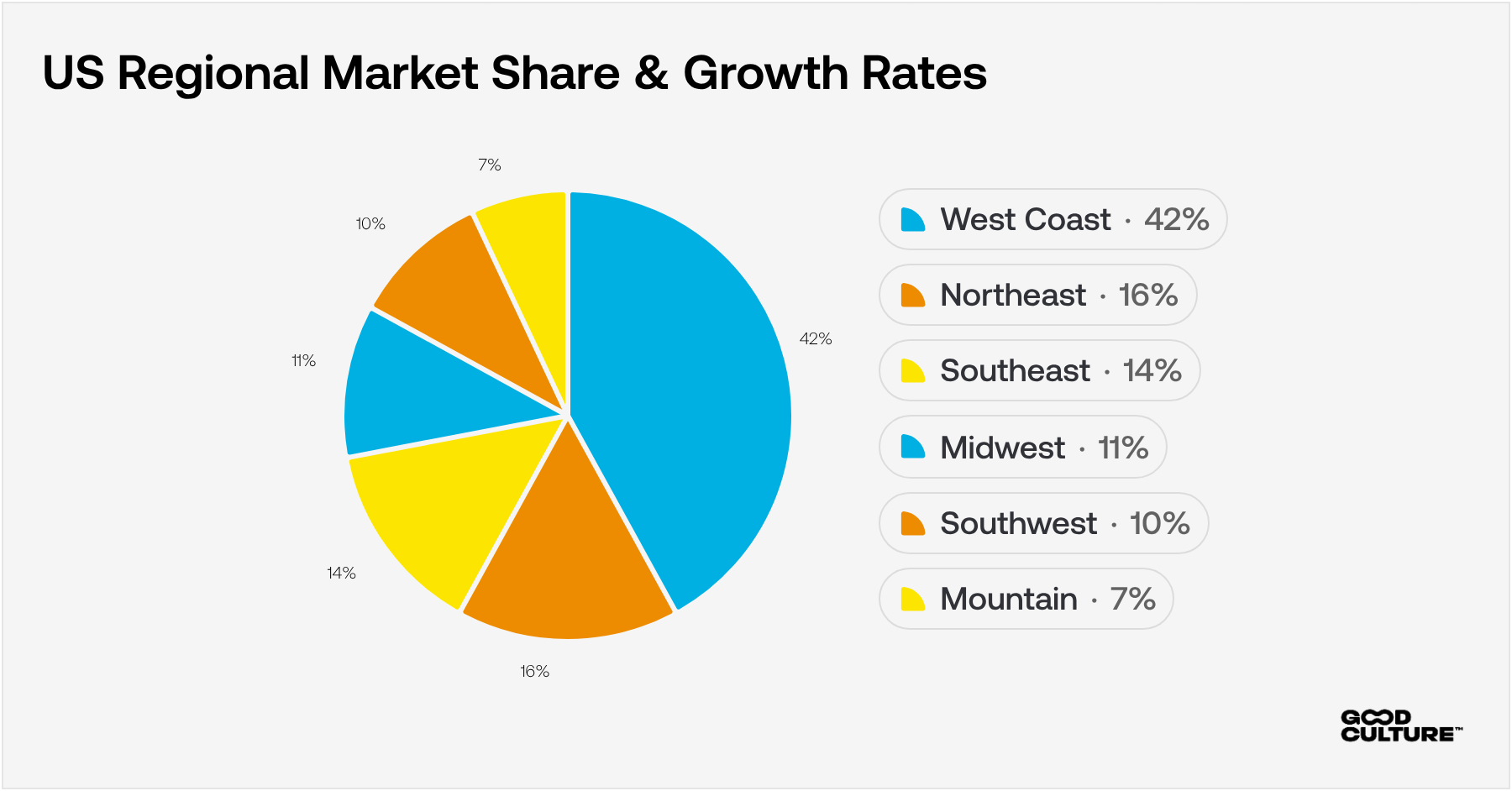

The West Coast (California, Oregon, Washington, British Columbia) remains dominant at 42% market share. But look at the growth rates. The real story is happening in the US Midwest and Southeast.

Texas, Florida, Georgia, and North Carolina are seeing 24-28% year-over-year growth. Ohio, Michigan, Illinois, and Wisconsin are growing even faster. These markets were largely ignored during kombucha's coastal growth phase. Now they represent the fastest-growing regional opportunities as mainstream US retail distribution through Walmart, Target, and regional grocery chains drives adoption.

Canadian markets outside Vancouver and Toronto are accelerating too. Calgary, Edmonton, Ottawa, and Montreal are seeing double-digit growth as kombucha enters conventional Canadian grocery and drugstore channels like Shoppers Drug Mart and Jean Coutu.

So what's driving growth in these markets? Price. Distribution. Familiarity. Midwestern and Southern US consumers aren't paying $4.99 for a bottle of fermented tea they've never tried. But they'll pay $2.49-2.99 when it's sitting next to the Vitamin Water and sparkling water they already buy. Regional brands targeting these markets with accessible pricing and mainstream distribution are capturing disproportionate share.

The Price War Nobody's Talking About

Here's an uncomfortable reality for premium kombucha brands: the North American market is bifurcating fast.

At the top end, you've got GT's, Health-Ade, and craft brands commanding $3.99-4.99 at Whole Foods and natural retailers. They're doing fine in their lane.

Then you've got the likes of Remedy ($2.49-2.79), private label ($1.99-2.49), and emerging brands willing to compete on price. And they're taking volume share rapidly across US and Canadian mainstream retail.

The middle is getting squeezed. Brands at $3.49-3.99 without clear differentiation are losing shelf space to cheaper alternatives that taste good enough. "Good enough" is the operative phrase. Most American consumers can't taste a quality difference justifying $1.50-2.00 premium when both products deliver on the core promise: tasty, lightly sweet, feels healthier than soda.

Research shows sharp demand elasticity around $3.00 in US and Canadian markets. Above that threshold, purchases become deliberate decisions. ones that require justification. Below it, beverages enter impulse territory. Brands achieving $2.50-2.99 retail are seeing volume growth 2-3x higher than premium competitors.

This isn't speculation. Walk into any Target or Walmart in America. Count how many facings go to products under $3.00 versus over. The market is voting with dollars, and it's voting for value without sacrificing taste.

Ready for 2026? Download the Global Kombucha Report for the trends, tactics, and insights you need to future-proof your brand.

Functional Sodas Are Eating Kombucha's Lunch

The competitive threat keeping North American kombucha brands up at night isn't other kombucha. It's functional sodas.

Olipop and Poppi (both California-based, now distributed nationally across the US and entering Canadian markets) are growing 50-100% year-over-year. They deliver similar gut health benefits with 2-5g sugar per can, taste closer to mainstream soda, and retail at $2.29-2.79—undercutting most kombucha.

When a health-conscious consumer in Target sees kombucha at $3.99 with 8g sugar and Olipop at $2.49 with 2g sugar, both claiming prebiotic benefits, which one are they choosing? The data shows they're increasingly choosing Olipop.

This is forcing the North American kombucha category to evolve. Health-Ade launched their "Plus" line targeting this exact threat. Remedy's zero-sugar positioning directly competes. Several emerging brands are launching with "low-sugar kombucha" as core positioning from day one.

The broader lesson: kombucha can't rely on "fermented = healthy" anymore. Functional sodas deliver similar health claims with better taste (for mainstream palates), lower sugar, and lower prices. North American kombucha brands need clearer differentiation or they'll keep losing share to alternatives that solve the same consumer need more efficiently.

What Retailers Actually Want

Conversations with US and Canadian retail buyers reveal what matters when they're deciding which kombucha brands get shelf space and which don't.

Consistency. When Target stocks your SKU in 500 stores, they need confidence every bottle tastes the same. One bad batch, one quality complaint that goes viral on TikTok, and you're done. Buyers remember these problems. Reliability matters more than innovation for mainstream US retail.

Competitive pricing. Walmart and Target buyers see the velocity data. Products under $3.00 move 2-3x faster than products over $4.00. They want brands that can deliver quality at mainstream price points because that's what drives category growth and their bonus structure.

Clean compliance. North American retailers have zero tolerance for alcohol compliance issues. US federal regulations plus varying state laws and Canadian provincial regulations create complexity. One SKU crosses 0.5% ABV during shelf life? That's a delisting conversation. Brands need systems ensuring this never happens.

Promotional support. Retailers want brands that can support in-store demos, digital coupons, and seasonal promotions without eroding already-tight margins. Brands offering better trade spend and promotional flexibility win shelf space from those that can't afford it.

For detailed guidance on staying compliant, see how to control alcohol in commercial kombucha production.

Hard Kombucha's Unexpected Impact

Hard kombucha became a $680 million category in North America, growing 40-45% annually. It's particularly strong in US states like California, Oregon, Washington, and Colorado, with growing Canadian presence in British Columbia and Ontario.

Here's why that matters for non-alcoholic brands: hard kombucha introduces the category to demographics who would never discover it through wellness channels.

Research shows approximately 3.2 million US consumers annually try hard kombucha first, then purchase non-alcoholic versions for everyday consumption. This is particularly pronounced amongst American males aged 25-45 - a demographic traditionally underrepresented in non-alcoholic kombucha but highly valuable once captured.

Major US hard kombucha brands (Booch Craft, Flying Embers, Kyla) are doing the marketing work to normalise kombucha for consumers who'd never set foot in a Whole Foods. When those consumers enjoy hard kombucha at a California brewery, they're more likely to buy regular kombucha at their local grocery store.

The gateway effect creates downstream benefits. Hard kombucha's success validates the category, normalises bolder flavour combinations, and introduces millions of new North American consumers who become potential regular customers for non-alcoholic brands.

Trends Shaping 2026

Several emerging trends will reshape the North American kombucha market over the next 12-18 months.

Cans Are Taking Over

Glass is losing. Cans are winning. Several leading US brands now offer can-only lineups.

Why? Cans cost less. They're lighter (reducing shipping costs across vast North American distances). They survive transport better. They feel more mainstream to American consumers already buying canned craft beer, hard seltzers, and sparkling water.

The perception that cans feel "less premium" has faded. US craft beer's successful transition normalised the format. Canadian consumers show similar acceptance. Expect accelerating can adoption across North American kombucha brands in 2026.

Low-Sugar Is Non-Negotiable

Research shows 76% of Americans actively limit sugar. 62% read nutrition labels before purchasing. Traditional kombucha at 6-10g sugar per 100ml creates cognitive dissonance for health-conscious consumers.

Successful North American brands are responding. Remedy's zero-sugar range. Health-Ade's reduced-sugar line. Several emerging brands launching with low-sugar as core positioning.

The category is splitting. Premium brands maintain higher sugar for taste. Value brands compete on low/no sugar to differentiate from functional sodas. The middle (moderate sugar, moderate price) is getting squeezed from both directions.

For formulation strategies, see how to formulate low-sugar kombucha without sacrificing flavour.

Regional Flavours Are Resonating

Bold flavour combinations inspired by North America's diverse populations are capturing attention in US and Canadian retail.

Mexican-inspired profiles (hibiscus-lime, tamarind-chile) resonate in Southwest and California markets. Asian-influenced flavours (yuzu-ginger, lychee-rose) perform well on the West Coast and Canadian urban markets with significant Asian populations.

These aren't gimmicks. They're authentic stories from North America's cultural diversity that help brands stand out in crowded coolers whilst appealing to specific regional demographics driving category growth.

What This Means for Brands

The North American kombucha market entering 2026 rewards brands that understand three realities:

Mainstream matters more than premium. The fastest growth is happening in US Midwest and Southeast markets through Walmart and Target, not coastal natural retailers. Brands optimised for that reality (competitive pricing, consistent quality, broad appeal) capture disproportionate volume.

Competition comes from outside the category. Functional sodas like Olipop and Poppi are the real threat, not other kombucha brands. North American kombucha needs clearer differentiation on taste, sugar content, or price to defend share.

Distribution access determines success. Regional brands remain regional because refrigerated distribution across North American distances is expensive. Brands solving that challenge (through better logistics, shelf-stable formulations, or strategic partnerships) unlock markets competitors can't economically access.

The opportunities outlined here are accessible for brands willing to adapt positioning and operations for North American market realities. The category is still growing. But the strategies that win in 2026 look very different from those that worked in 2020.

Explore our full range of fermented beverage solutions designed for North American commercial producers.

Download our free Kombucha Troubleshooting Guide for production insights.

Frequently Asked Questions

-

The North American market reached $2.1 billion in 2025, with the US accounting for roughly 85% and Canada 15%. Growth continues at 13.9% CAGR, in line with broader functional beverage trends.

-

The West Coast remains dominant at 42% market share. But the Midwest and Southeast show the highest growth rates (24-28% YoY), driven by mainstream retail expansion through Walmart, Target, and regional grocery chains.

-

Functional sodas like Olipop and Poppi represent the primary threat. They deliver similar gut health claims with 2-5g sugar per can, taste closer to mainstream soda, and retail $0.75-1.50 cheaper than most kombucha. They're growing 50-100% annually and capturing health-conscious consumers who might otherwise buy kombucha.

-

Hard kombucha ($680M category growing 40-45% annually) creates a gateway effect, introducing approximately 3.2 million new US consumers annually who subsequently buy non-alcoholic versions. This particularly impacts males aged 25-45, a demographic traditionally underrepresented in non-alcoholic kombucha.

-

Research shows demand elasticity around $3.00. Brands at $2.50-2.99 see volume growth 2-3x higher than premium competitors at $3.99-4.99. Successful examples include Remedy ($2.49-2.79) and private label ($1.99-2.49).

-

US: Walmart, Target, Kroger, Whole Foods, Trader Joe's, and Costco. Canada: Loblaws, Sobeys, Metro, Whole Foods, and Costco. Convenience chains (7-Eleven, Circle K in US; Mac's, Couche-Tard in Canada) represent emerging opportunities for ambient-stable formats.