What Consumption Habits Mean for Non-Alc (and Your Bottom Line)

The days of "Dry January" being the only peak in the Non-Alc calendar are long gone. We're witnessing a fundamental restructuring of how people drink, rather than simply what they drink.

For beverage manufacturers, this shift is no longer about offering a single alcohol-free SKU to tick a box. It's about engineering liquids that fit into the complex, high-performance lives of the modern consumer.

As we detail in our Kombucha Report 2026, the market is maturing. The novelty phase is over. We're now in the optimisation phase. Here's what the latest consumption habits – and the hard data behind them – mean for your formulation strategy.

The Great Volume Shift: A $46.5bn Opportunity

If you need a reason to invest aggressively in your Non-Alc pipeline, look at the valuation. The global low and no-alcohol market is projected to hit USD 46.5 billion by 2034.

This isn't a future forecast. It’s happening on the shelf right now. Retailers are seeing immediate returns, with major grocers like Waitrose reporting a 32% surge in no/low sales in just a single summer.

Global alcohol volumes are projected to decline by -0.4% in 2025, with wine taking the hardest hit at -2.4%. The Ready-to-Drink (RTD) category is absorbing this volume.

This is where the money is moving. Retailers are actively looking for functional, sophisticated liquids to fill the gap left by shrinking wine and beer sections. The manufacturers who understand functional beverage production and can deliver a complex, shelf-stable adult beverage will capture this volume.

Function Stacking: Why "Just Hydration" Isn’t Enough

The modern consumer is efficient. They want more than a drink. They want a tool.

This demand has birthed the biggest trend of the decade: Function Stacking.

Consumers are increasingly looking for beverages that do double (or triple) duty. They aren't looking for a standard Non-Alc beer. They want one with added electrolytes for recovery. They don't want a simple soda. They want gut-health benefits combined with a caffeine kick.

For R&D teams, this presents a unique challenge. How do you stack functional ingredients – adaptogens, nootropics, vitamins – without it feeling like you've created a chemical soup?

The Solution: The Fermentation "Cheat Code"

This is where a robust fermented base becomes your R&D superpower. Fermented bases are the cheat code for creating legitimate, sessionable drinks that compete on taste.

Our Organic Green Tea Fermented Base acts as a bio-available delivery system. It gives you the "base layer" of gut health (acetic and gluconic acids) that consumers already trust. This creates a halo effect for whatever other function you stack on top.

Takeaway: Don't formulate in a vacuum. Start with a base that carries its own weight in functional claims.

The Rise of the "Zebra Striper"

Forget the binary of "drinker" vs. "non-drinker". The most exciting demographic for 2026 is the Zebra Striper – the consumer who alternates between full-strength alcohol and Non-Alc options throughout a single night.

The data confirms the scale of this shift: 78% of Gen Z now actively alternate between alcoholic and non-alcoholic rounds to pace their night. This behaviour isn't driven by abstinence. It's driven by longevity. They want to stay at the party longer without the hangover.

What this means for formulation:

You can't serve these drinkers sugar-water. They're switching from a complex IPA or a tannic Pinot Noir to your beverage. If your mouthfeel is thin or your organoleptic profile is one-note, you lose them.

To win the Zebra Striper, you need complexity. You need the "burn," the tannin, and the length that only fermentation can provide. Using a long-aged base, such as our Organic Black Tea Fermented Base, mimics the complexity of alcohol – specifically the acetic bite that signals "adult beverage" to the brain – without the ABV.

Who’s Winning? (And Why)

If you want to know where the market is going, look at who's winning. The landscape is splitting into two camps: the Titans buying their way in, and the Challengers innovating on function.

The Titans (Validation):

When Diageo acquires a brand like Ritual Zero Proof (as they did in 2024), it signals that the world's biggest spirits company knows the future is alcohol-free. Similarly, LVMH investing in French Bloom proves that even the luxury sector demands Non-Alc options.

The Challengers (Inspiration):

The real R&D inspiration comes from the brands building on function rather than flavour mimicry:

Aplós: This functional spirit brand recently secured $5M in funding after hitting +400% growth. Their success came from leaning heavily into "functional spirits" that offer a mood-altering effect (using hemp and adaptogens) rather than attempting to taste exactly like gin.

Three Spirit: Their "Nightcap" drink is designed specifically for relaxation, using valerian root and lemon balm. They aren't selling a fake whisky. They're selling a feeling.

Athletic Brewing: They proved that if the product tastes authentic, the scale will follow. They're dominating the Non-Alc beer segment because they refused to compromise on the brewing process.

The Lesson: The winners are those who offer a genuine "adult" experience – whether through complex fermentation or functional benefits.

Clean Label 2.0: The UPF Backlash

2026 is the year that many more consumers are turning their back on ultra processed foods (UPF).

Consumers are waging war on long ingredient lists. They're scrutinising labels for gums, stabilisers, and synthetic acids. The "Clean Label" movement has evolved from a preference to a hard requirement for Tier 1 retail listings.

Fermentation as the Antidote

Fermentation is the ultimate clean label story. It allows you to replace synthetic preservatives and flavour enhancers with a natural process.

When you acidify your beverage with a fermented kombucha base rather than lab-created phosphoric or citric acid, you change the narrative. You aren't simply changing the pH. You get to put "Naturally Fermented" on the front of the can – a claim that neutralises the "processed" stigma.

For brands navigating the complex landscape of quality and safety assurance, fermentation provides a clear path to compliance.

Scale or Fail: The Velocity Trap

Here's the hard truth we discuss in the Kombucha Report 2026: Demand is spiking, but retail patience is thinning.

When a major retailer (think Whole Foods or Target) validates the Non-Alc trend, they demand volume immediately. We're seeing brands win the listing but lose the war because they can't scale production fast enough to meet velocity requirements.

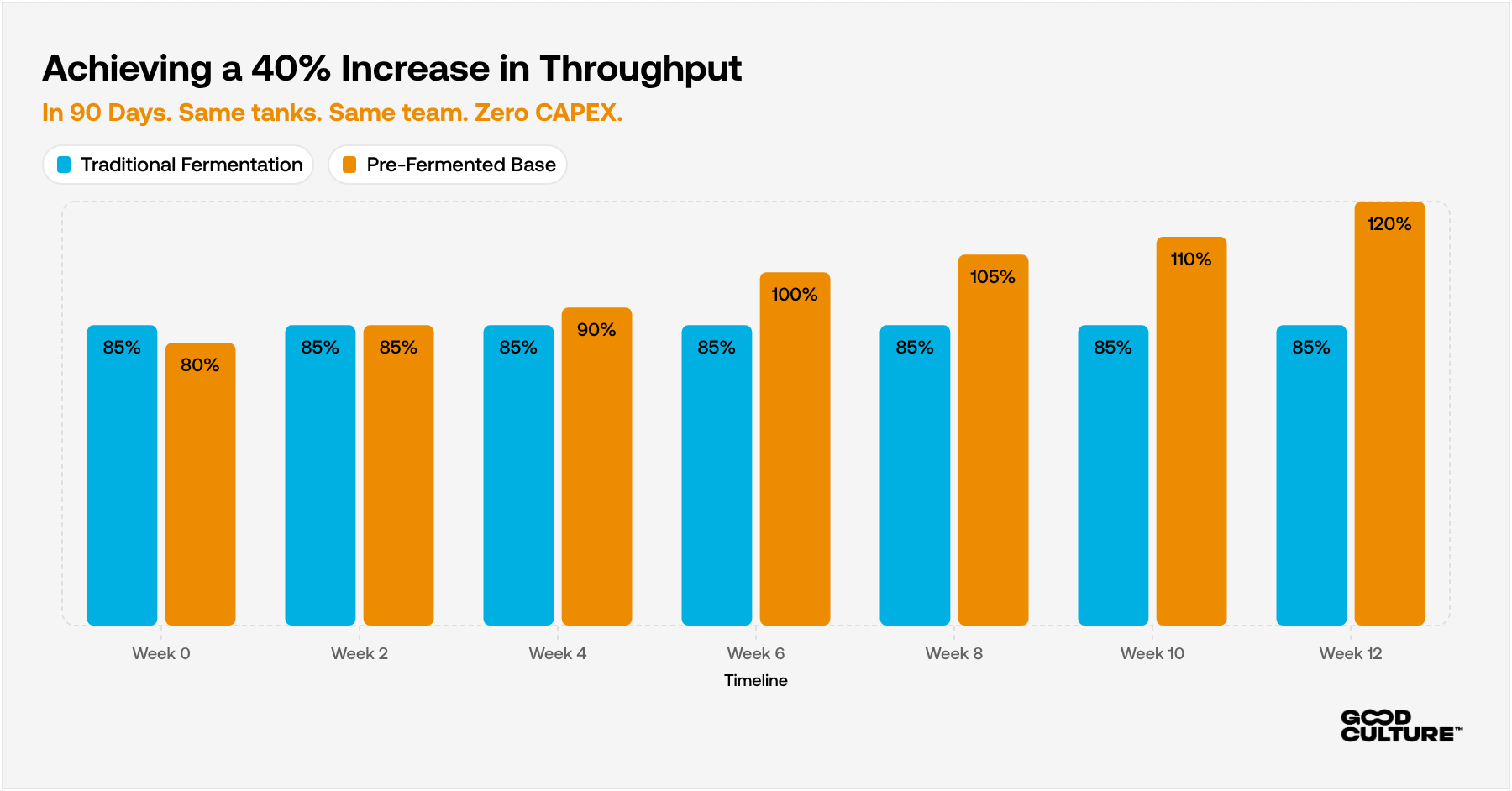

Traditional brewing cycles that last a long time are a bottleneck that kills momentum.

This is why we advocate for elastic capacity. By using a high strength, long aged ingredient like our bases, you reduce lead times from weeks to 24 hours. You aren't waiting on yeast. You're compounding and bottling.

In a market where shelf space is a battleground, agility is your best inventory strategy. If you're currently facing bottlenecks, you need a roadmap for scaling your drinks business without massive CapEx.

Ready to Optimise?

The consumption habits of 2026 demand beverages that are functional, complex, and clean. The volume opportunity is real, but only for those who can scale quality.

For the full breakdown on where the market is heading, read our Kombucha Report 2026. Or, if you want to discuss how these trends fit your formulation strategy, contact our team. Let's explore your ideas and ensure your next launch is engineered to capture the Zebra Striper.